📱 The software-defined cabin

The power of smartphone ecosystems over cars

At WWDC 2022, Apple unveiled the “next generation” CarPlay:

This newsletter offers deep takes on the intersections between mobility and technology. You can subscribe here:

The updated offering integrates with all the screens in the vehicle (including instrument cluster) and allows deeper control of vehicle functions, including climate control.

I have seen this console - which has a lot of information like a calendar displayed - described as overwhelming in comparison to the minimalist Tesla Model 3. The critical thing is that the comparison is a natural one to make - Apple’s software allows carmakers to offer a customer experience that compares to Tesla’s. It is on digital experience that carmakers have fallen behind, while the digitized driving experience has increasingly come to define Tesla’s brand dominance (see: Is TSLA a tech stock or a fashion product?).

This critique that it is overwhelming also misses the key advantage of software: when Apple owns digital real estate, just like with the Apple Watch, it can mold according to each user’s preferences.

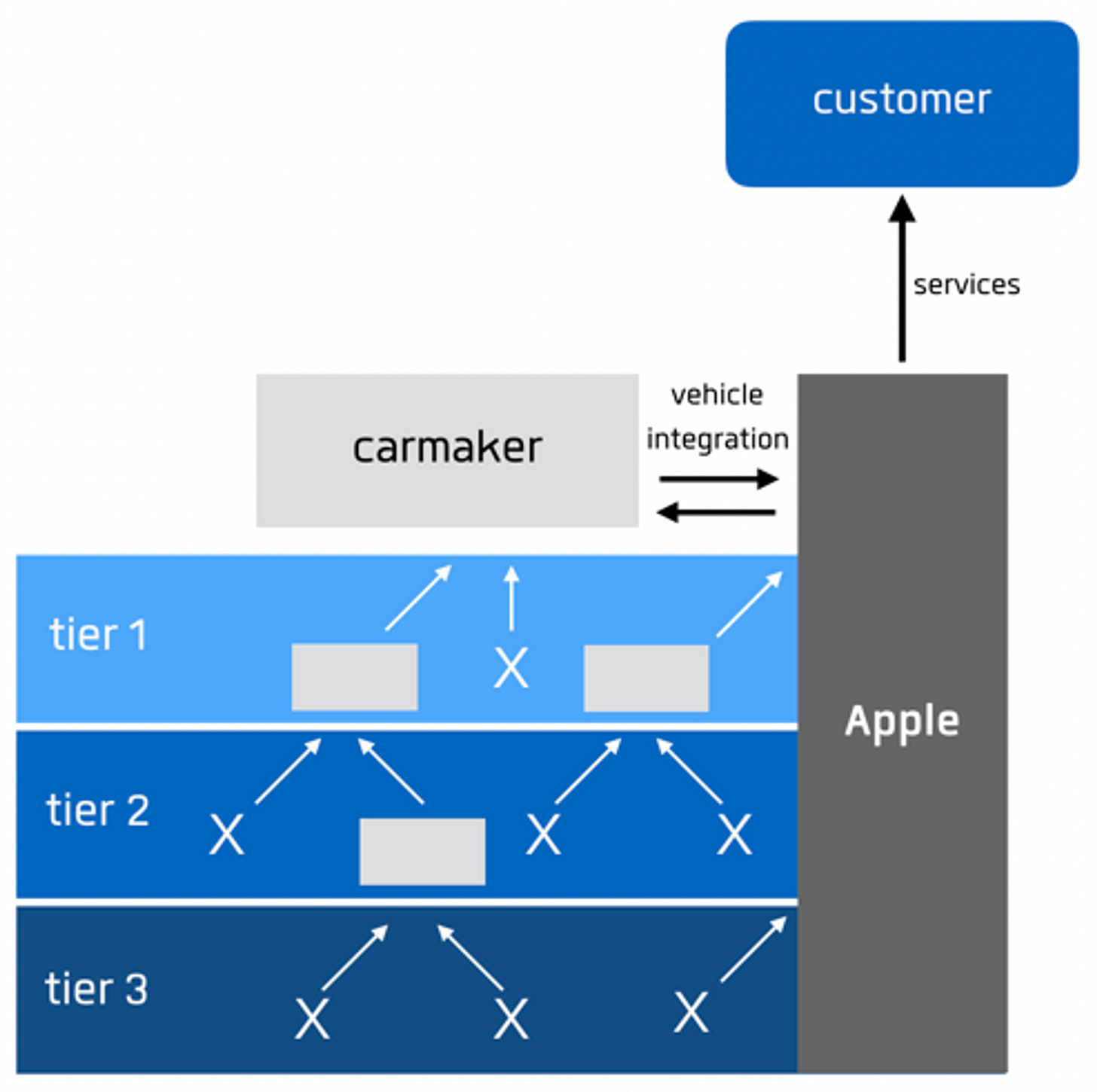

The question is how deep this goes. In 2016, I wrote about the automotive opportunity for Apple. Rather than building the full car, I argued that Apple can integrate deeply into vehicles leveraging its strength in silicon and UX design to capture value while avoiding the liability and pain of vehicle manufacturing:

This integration is still relatively shallow compared to where it may go. The silicon in vehicles is still very distributed and the opportunity for Apple to get deeper into the brain of a vehicle is a fascinating though complicated one.

The power of smartphone app ecosystems have seeped into consumer expectations of their cars. Tesla’s shown consumers they can expect more. But this process elsewhere has been relatively slow in comparison to China. Whereas our grandparents bought cars similar to the ones we still drive, in China, most car-owners were smartphone-owners first. They expect digital integration as a default.

So while Apple (along with Google), a smartphone company, is increasingly moving into the car, it is notable that Geely, perhaps the most important carmaker in China (which also owns Volvo and Lotus) just acquired Meizu, a once-leading smartphone company and seems interested in manufacturing phones (link). Meanwhile, it also just started launching its own array of low earth satellites with the goal of enabling low latency connectivity to its vehicles and positing to enable autonomous functionality. Finally, Geely has launched a JV with Baidu to make an “autonomous vehicle”… creatively named Jidu (as in Geely=Ji and Baidu=du) (link). The company has aggressive plans to commercialize their first vehicle, the delicately named ROBO-01 which they just unveiled (link).

Baidu is the Google of China and has been developing autonomous technology for years. But this car is not designed to be fully autonomous any time soon - autonomy here is a feature targeted at “users who like cutting-edge technologies.” Much like Tesla’s perpetually delayed FSD, the point of “autonomy” in this context is more about cabin experience and brand mystique than it is about changing the business model of transportation as Cruise or Waymo aim to do. But for now, this is a key part of the battleground in order to sell vehicles that are electric and digitized to the masses.

This article was first published in the RedBlue Newsletter on June 17, 2022.